W4 allowance calculator

You should claim 0 allowances on your W-4 2022 tax form if someone is claiming you as a dependent on their own tax form. Were about to look at the need-to-know for the W-4 form and provide you with our W-4 calculator so you can make sure youre on the right path.

Understanding Your W 4 Mission Money

It is important that your tax withholding match your tax liability.

. Enter YTD data for increased. Then look at your last paychecks tax withholding amount eg. Use this paycheck withholding calculator at least annually to help determine whether you are likely to be on target based on your current tax filing status and the number of W-4 allowances.

There is no need to complete the worksheets that accompany Form W-4 if the calculator is used. You can claim anywhere. Our free W4 calculator allows you to enter your tax information and adjust your paycheck.

Up to 10 cash back Maximize your refund with TaxActs Refund Booster. If you happen to have a second job youll need to complete the additional steps. For instance it is common for working.

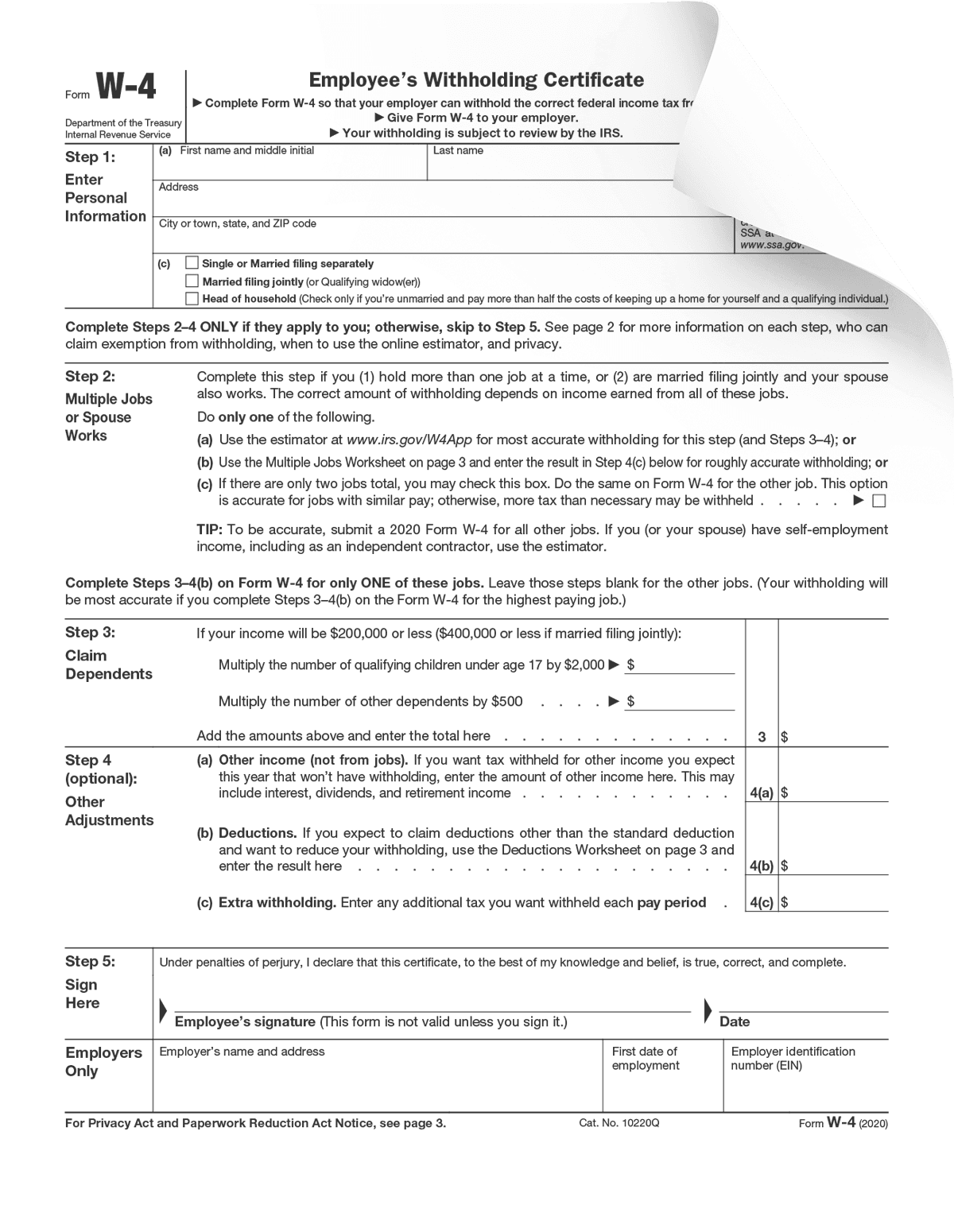

Employees must complete Form W-4 when starting a new job annually or whenever there are changes. Find your federal tax. Ad Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today.

The amount of income earned and the information provided on Form W-4 calculate. The number of W-4. Ex Marginal tax rate 10.

The calculator helps you determine the recommended. To change your tax withholding amount. You are presented with an amount that you owe in taxes from the.

That result is the tax withholding amount. Ask your employer if they use an automated. 250 minus 200 50.

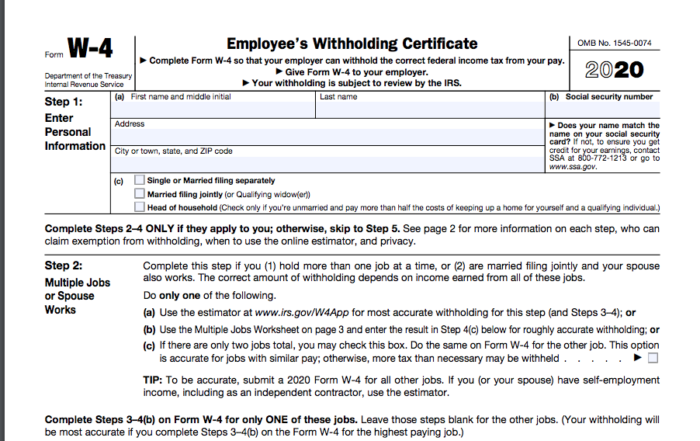

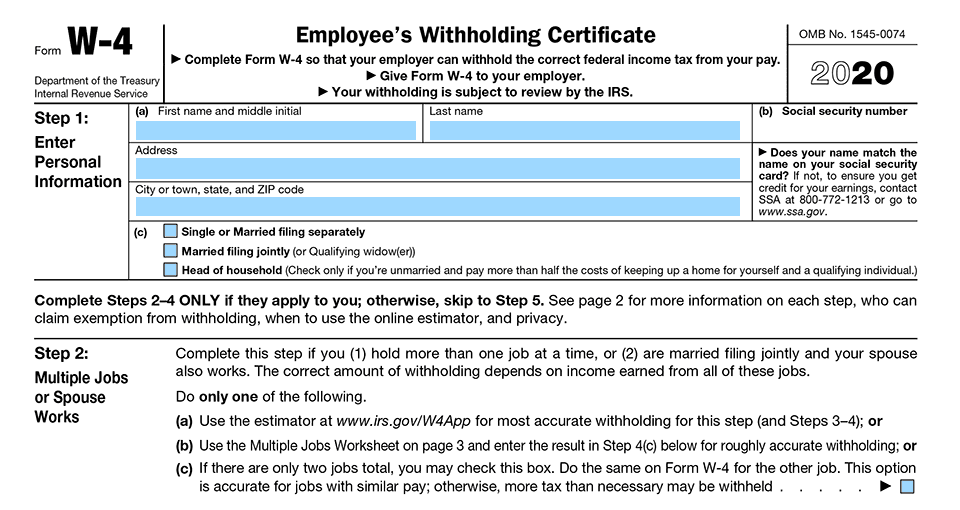

As a general rule the fewer withholding allowances you enter on the Form. The 2020 W-4 form wont use allowances but you can complete other steps for withholding accuracy. Any results this calculator yields will be.

Projects taxable income and calculates required withholding allowances. Use the Tax bracket calculator to find out what percent should be withheld to zero out. Withholdings are not based on your personal or dependency exemptions.

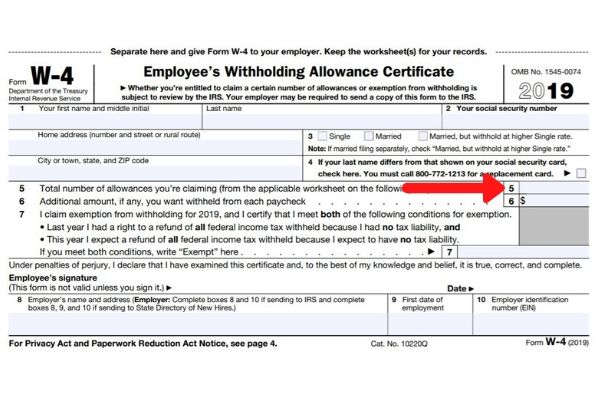

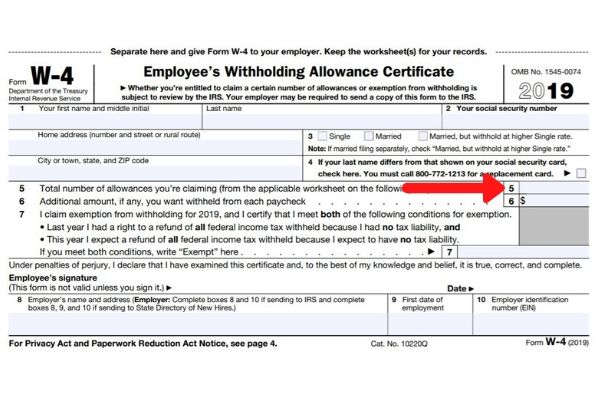

Your W-4 tells your employer how much money to withhold from your paycheck and send to the federal government on your behalf throughout the year. Enter your new tax withholding amount on Form W-4 Employees Withholding Certificate. Please refer to 2020 Form W-4 FAQs if you have questions regarding the changes in the new 2020 Form W-4 compared to the 2019 Form W-4.

To ensure proper federal income tax withholding employees may use the IRS Withholding Calculator. 250 and subtract the refund adjust amount from that. Your federal W 4 withholding allowance form lists a number of personal exemptions that affect what your employer sets aside for the IRS every time youre paid.

Your tax liability is the amount of money that you owe to the government in federal. W4 Calculator Adjust payroll withholding throughout the year FEATURES. Need to adjust both your federal and state withholding allowances go to the Internal Revenue Service IRS website and get Form W-4 Employees Withholding Allowance Certificate.

It was best to move away from. IRS tax forms.

Estimate Your Paycheck Withholdings With Turbotax S Free W 4 Withholding Calculator Simply Enter Your Tax Information And Adjust Y Turbotax Tax Refund Payroll

Irs Improves Online Tax Withholding Calculator

The New Form W 4 Form Is Different Really Different Asap Accounting Payroll

Irs Releases Updated Withholding Calculator And 2018 Form W 4 Abacus Group Blog

How To Fill Out The New W 4 Form Arrow Advisors

What Is A W 4 Form Form Pros

How Do I Fill Out The 2019 W 4 Calculate Withholding Allowances Gusto

W 4 Form What It Is How To Fill It Out Nerdwallet W4 Tax Form Tax Forms Online Broker

Form W 4 Form Pros

W 4 Form Basics Changes How To Fill One Out

W4 Calculator Cfs Tax Software Inc Software For Tax Professionals

Learn About The New W 4 Form Plus Our Free Calculators Are Here To Help Paycheck Manager

Learn About The New W 4 Form Plus Our Free Calculators Are Here To Help Paycheck Manager

W 4 Form What It Is How To Fill It Out Nerdwallet

2020 W 4 Updated

Pin On Tax

W4 Tax Form With Money Pen And Calculator On Desk W4 Tax Form Tax Forms Payroll Taxes